The InSpeier Guide to Survey Length & Engagement

In the world of market research, the "Ideal" length is less about a specific minute count and more about the Value-to-Effort ratio. I’ve outlined the industry standards and the "sweet spots" that ensure you don't experience high abandonment rates while still getting the "bulletproof" data InSpeier is known for.

1. The "Golden Rules" by Survey Type

The Pulse Check (NPS/Transactional/Point in Time): 1–2 minutes (max 3 questions)

Best for: Immediate feedback after a purchase or support call

The Customer Experience (CX) Deeper Dive: 5–10 minutes

Best for: Understanding the "why" behind the friction points in your funnel

The Strategic/Product Development Survey: 10–15 minutes

Best for: Medtech, B2B surveys or B2C creative testing. This requires an incentive (e.g., a gift card or other monetary value).

2. The "Cliff" (Abandonment Benchmarks)

Data across millions of responses shows a clear pattern of diminishing returns:

Under 5 Minutes: Highest completion rates (80%+)

5–10 Minutes: Very stable for B2B and engaged B2C customers (65-80%)

15+ Minutes: The "Cliff." Expect a 20–30% drop in completion rates unless the respondent is highly invested (e.g., a physician or long-term customer or partner who is incentivized)

3. InSpeier's Strategy for "Long" Surveys

If your strategy requires a deep dive that exceeds 10 minutes, use these professional "insurance" tactics:

The Progress Bar: Always show respondents how far they are. Uncertainty is the biggest driver of abandonment.

Front-Load the "Must-Haves": Put your critical strategic questions in the first 30% of the survey and use the last 30% as demographics and easy-to-answer softballs.

The "Mobile-First" Test: If your 10-minute survey takes 20 minutes to tap through on a phone, it’s too long. Optimize for thumbs, not just cursors.

The "So What?" Filter: For every question, ask: "Will the answer to this question change a business decision this year?" If the answer is "no," cut it.

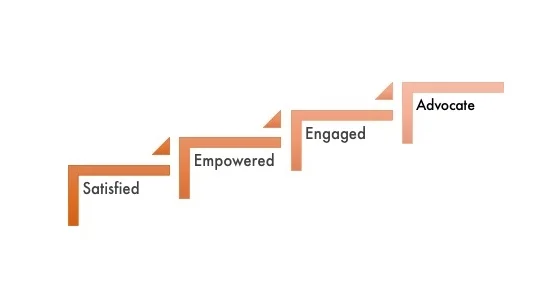

Remember, you’re asking your customers about their experience with your brand. Treat the survey as another extension of that brand and respect their time. When the respondent feels like a partner rather than a data point, they will give you more time and higher-quality insights.